- 27.02.2024.

- News, Regulations

If you are attracted to the idea of your own business venture in nautical tourism, you are in the right place. Katarina Ćosić brings all the essential information about starting a yacht charter business in Croatia, from legal frameworks to practical tips.

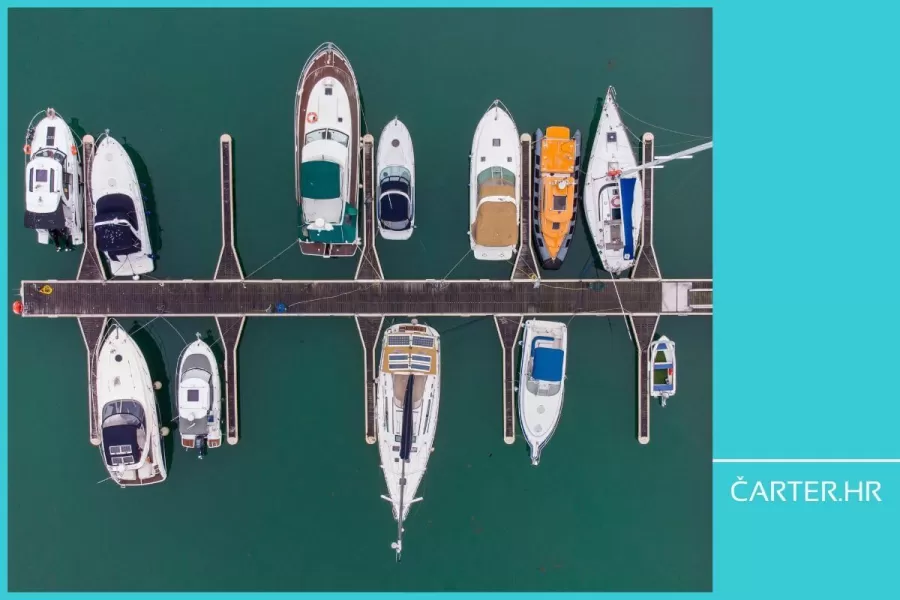

Considering the growing popularity of nautical tourism in the Republic of Croatia, opening a yacht charter company appears to be a logical choice.

This type of business requires careful planning and compliance with relevant regulations. A careful approach that includes understanding the regulatory framework and adhering to the highest standards of service will result in the success of the company's operations.

In the rest of the article, we will discuss the guidelines for opening a yacht charter company by foreign persons, the legal framework, and the approvals needed for the charter company to start operating.

Legal requirements for opening a yacht charter company

Foreigners who want to establish a yacht charter company in the Republic of Croatia must comply with legal requirements and procedures.

It is important to note that laws can change, so it is always necessary to follow the current legislation or to hire professional legal assistance for this purpose.

A foreigner can carry out his activity in the Republic of Croatia only if he establishes a commercial company in the Republic of Croatia or a foreign branch of a foreign company.

All issues related to the performance of charter activities in internal sea waters and the territorial sea of the Republic of Croatia are managed by the Ordinance on the conditions for the performance of the activity of renting vessels with or without a crew and the provision of accommodation services for guests on the vessel.

Charter activity can be performed by any owner or user of a vessel registered for commercial purposes, with the condition of establishing a company or trade for that activity (yacht charter company) with headquarters in the Republic of Croatia or by concluding an appropriate agreement between the owner or user of the vessel with a charter company registered in the Republic of Croatia, on the basis of which the yacht charter company takes over powers and responsibilities for managing the vessel prescribed by the Ordinance.

A foreign yacht charter company with headquarters outside the Republic of Croatia can independently perform charter activities in the Republic of Croatia, on the condition that it obtains OIB and VAT ID number issued by the tax authorities of the Republic of Croatia. In this case, the yacht charter company is obliged to submit information about the tax representative in the Republic of Croatia to the Ministry as a person who performs all tasks related to determining and paying VAT.

Yacht charter activity can be performed:

- by a vessel belonging to the Croatian state

- by a vessel belonging to an EEA member state or

- by a vessel belonging to a third country for which a cabotage permit has been obtained.

The conditions for foreign nationals of third countries to open a company in Croatia are somewhat different from the conditions for citizens of the European Union or EEA citizens. The differences between foreigners from third countries and foreigners from the EU refer to the company's share capital and the obligation to employ workers from Croatia or another member of the European Union.

Steps for establishing a yacht charter company

Foreigners who want to open a yacht charter company in the Republic of Croatia should follow specific steps and fulfil legal requirements. Here's an overview of those steps:

1. Obtaining the OIB - foreign natural persons have to attach the original passport for inspection, and a copy is attached to the Application. Foreign legal entities must attach an act of incorporation to the application for creation of an OIB (decision or extract from the relevant registry, which must be in the Croatian language or translated into Croatian by an authorized court interpreter). OIB can be obtained at tax administration branches on the same day. It is also possible to issue an OIB through a proxy.

2. Choosing the company's name - the company name of the trading company must be in Latin, Croatian, or the official language of one of the EU members. Arabic numbers can also be used. The availability of names can be checked free of charge on the Court Registry website.

3. Certification of documents - the following documents must be certified by a public notary:

- application for registration in the court register,

- founding deed - article of association (signed by all founders) or declaration of company foundation (if the company is founded by only one person),

- statement of the members authorized to represent the company on acceptance of the placement,

- the decision on the appointment of board members,

- signature of the director or signatures of members of the board, signatures of members of the supervisory board (if the company has a supervisory board),

- the decision on the appointment of the Procurator of the company and his signature (if the company has a Procurator), the decision on determining the company's address.

It is necessary to bring a passport for authentication.

The presence of all founders and other persons whose signatures need to be certified is mandatory.

All documentation in a foreign language must be translated by a court interpreter.

4. Registration in the court register

After the certification of the documents mentioned above, an application for registration in the court register with all necessary annexes is submitted, which initiates the procedure for registration in the court register at the commercial court. After entry into the court register, the commercial court delivers the decision.

5. Publication of the registration of the company

After the decision on entry into the court register has been made, information about the entry is published without delay on the website where the register is located.

6. Classification by activities

A request for classification by activity according to the National Classification of Activities is submitted to the State Statistics Office. The registry number and activity code are obtained within 15 days from the date of receipt of the decision on entry into the court register (the request to the State Statistics Office can be sent by e-mail).

7. Opening a bank account

Upon receipt of the Classification Notice, a Giro account can be opened at the bank.

The share capital (EUR 2,654.46 for a limited liability company or EUR 26,544.56 for a joint-stock company) must be deposited in a bank account, and the deposit certificate must be submitted when registering the company.

The share capital can also be deposited with FINA, which, upon company registration, disposes the money into an open bank account.

8. Application for pension insurance (HZMO)

The Application for the start of business of the contributor must be submitted at the counter of the Croatian Pension Insurance Institute or electronically.

9. Application for health insurance (HZZO)

The Application for the person liable to pay contributions, the Application for basic health insurance for an insured person and the Application for basic health insurance for a family member must be submitted at the Croatian Institute for Health Insurance desk in Fina within 15 days of starting business.

10. Application to the Tax Administration

After registration in the court register and the register of the State Bureau of Statistics, it is necessary to register the company with the tax administration at the competent authority of the place where the company is established for registration in the register of taxpayers.

Tax obligations for yacht charter companies

As the introduction states, the yacht charter includes renting a vessel or providing accommodation services on a vessel in internal sea waters and territorial seas.

Different tax rates are applied when accommodation is provided on the vessel, compared to renting a vessel without accommodation.

The application of tax rules is also affected by the time of service performance. Different rules for determining the place of taxation are applied in the case of short-term boat charters compared to long-term boat charters.

Which tax rules will be applied also depends on whether the recipient of the charter is a taxpayer or an end user, i.e. whether he is domiciled in the Republic of Croatia or in another member state of the European Union, i.e. a third country.

The VAT Act stipulates that VAT is calculated and paid at a rate of 25% and at a reduced rate of 13% on accommodation or accommodation with breakfast, half board or full board in hotels or facilities of similar purpose, including accommodation during holidays, renting space in holiday camps or in places designated for camping and accommodation in nautical tourism facilities.

It follows from the above that it is taxed at the tax rate:

- 13% – charter service with accommodation;

- 25% – renting a boat without accommodation.

Other tax obligations of the yacht charter company will depend on the business plans.

Vessel registration and licensing for yacht charter operations

Vessel registration and licensing for yacht charter operations in the Republic of Croatia are subject to certain procedures and rules compatible with European maritime regulations.

The request for the first boat registration is submitted to the harbour master's office or the office that maintains the Register of Ships. The Register of Ships is a single register of maritime objects of Croatian nationality.

In the event of a change in ownership of the boat, the new owner of the boat is obliged to request a change of data in the Register of Ships within 30 days from the date of acquisition of ownership.

There are various uses of boats in the Republic of Croatia, including boats for personal needs, commercial purposes and public use.

The request for vessel registration can be submitted through the e-Citizens system, electronic mail or directly at the harbour master's office.

To perform charter operations, obtaining a license for the use of the radio frequency spectrum on the vessel is necessary.

Also, you need to register the crew and passengers on the vessels. A yacht charter company that plans to carry out charter activities in the Republic of Croatia before starting to use the vessel is obliged to submit a written request to the Ministry of the Sea, Transport and Infrastructure for the granting of user rights to work on the central database (Request for eCrew), on the basis of which the Ministry grants user rights for access to the e-Crew system.

e-Crew enables yacht charter companies to submit mandatory crew and passenger lists online no later than the moment the vessel sets sail.

What are the opportunities for hiring foreign staff?

Citizens of EU/EEA member states can work in the Republic of Croatia without a residence and work permit or work registration certificate.

The Law on Foreigners prescribes the conditions for entry, movement, residence and work of foreigners who are citizens of third countries (hereinafter: citizens of third countries) in the Republic of Croatia.

A citizen of a third country may work in the Republic of Croatia on the basis of a residence and work permit or a certificate of employment registration unless otherwise prescribed by this Act.

In the sense of this Act, the performance of previous actions for the establishment and registration of a commercial company or trade is not considered work.

A citizen of a third country who performs tasks in a trading company, branch or representative office of a foreign trading company is considered to be:

1. a person who has a higher position in a trading company, branch or representative office, a person who manages the business, a person who is under the general supervision or management of the board or shareholders or members of the trading company, and a person who holds a similar duty, including:

- managing the work of a department or subdivision of the company

- monitoring and supervising the work of other workers, i.e. performing supervisory or managerial tasks

- the authority to decide on hiring and firing workers, i.e. giving recommendations related to hiring, firing or other personnel matters

2. a highly qualified person who works in a trading company, branch or representative office who possesses special professional knowledge and/or powers that are absolutely necessary for providing services, using research equipment, applying techniques or managing the business of a trading company, branch or representative office.

A citizen of a third country can be issued a residence and work permit if the conditions defined by the Foreigners Act are met and if he proves that:

1. the value of the share capital of a trading company, i.e. the assets of a limited or public trading company, exceeds the amount of EUR 26,544.56

2. at least three Croatian citizens are employed on an indefinite and full-time basis in a trading company, branch or representative office of a foreign trading company in jobs other than Procurator, member of the board or supervisory board, and whose gross salary is at least the amount of the average gross salary paid in the Republic of Croatia in the past year according to the officially published data of the state administration body responsible for statistics

3. his gross salary is at least 1.5 times the average gross salary paid in the Republic of Croatia in the past year, according to the officially published data of the state administration body responsible for statistics.

If several third-country nationals perform key tasks for the same employer, a residence and work permit may be issued if:

1. the value of the share capital of a trading company, i.e. the assets of a limited or public trading company, exceeds the amount of EUR 26,544.56

2. for every employed citizen of a third country, at least three Croatian citizens are employed on an indefinite and full-time basis in jobs other than Procurator, member of the board or supervisory board, and whose gross salary is at least the amount of the average gross salary paid in the Republic of Croatia in the past year according to officially published data of the state administration body responsible for statistics

3. their gross salary is at least 1.5 times the average gross salary paid in the Republic of Croatia in the past year, according to the officially published data of the state administration body responsible for statistics.

A citizen of a third country who is self-employed in a business or trade in which he is the sole owner can be issued a residence and work permit if he meets the requirements of the Foreigners Act and if:

1. has invested at least 26,544.56 euros in establishing a trading company or trade

2. at least three Croatian citizens are employed on an indefinite and full-time basis and whose gross salary is at least the amount of the average gross salary paid in the Republic of Croatia in the past year, according to the officially published data of the state administration body responsible for statistics

3. his monthly gross salary is at least 1.5 of the average monthly gross salary paid in the Republic of Croatia, according to the last officially published data of the state administration body responsible for statistics. At the same time, a citizen of a third country who is self-employed in his own trade must prove that the amount earned from self-employment income is at least 1.5 of the average monthly net paid salary in the Republic of Croatia according to the last officially published data of the state administration body responsible for statistics.

Advantages and challenges of operating a yacht charter company in the Republic of Croatia

Operating a yacht charter company in Croatia can have certain advantages, but it also brings challenges. It is essential to carefully evaluate these factors before deciding to start such a business.

Here are some advantages and challenges of operating a yacht charter company in the Republic of Croatia:

Advantages

Tourist destination: Croatia is a popular tourist destination with a beautiful coast, islands and natural beauty, which can attract many tourists interested in chartering a boat.

A variety of offers: Croatia offers a variety of boat charter options, including sailboats, motorboats and catamarans. This enables the offer to be adjusted according to the different needs of clients.

Nautical tourism: Croatia has a developed infrastructure for nautical tourism, including marinas, anchorages and ports, which facilitates the operation of yacht charter companies.

Connection with other destinations: connecting with other European destinations enables easier client access and business expansion to a broader market.

Growing market: nautical tourism in Croatia is growing, which can provide opportunities to increase income and expand business.

Challenges

Seasonal business: the business of a yacht charter company in Croatia often depends on seasonal variations, with more work during the summer months. This can mean challenges in maintaining a steady income throughout the year.

Competition: competition in nautical tourism can be intense. Investing efforts in the differentiation of services is necessary to attract clients.

Regulation: maritime regulations and laws relating to nautical tourism can be complex and subject to change. The operation of a yacht charter company requires constant monitoring and adaptation to new regulations.

Boat maintenance: boat maintenance can be expensive, and regular investment is required to ensure the safety and functionality of the boat.

Marketing and promotion: effective marketing and promotion are crucial to attracting clients. Companies must develop advertising strategies to stand out in the mass of information available to tourists.

Before starting a yacht charter company in Croatia, detailed market research, legal and regulatory requirements, and careful consideration of the advantages and challenges are recommended.

Categories of trends

- News

- Sale

- Marketing

- SEO

- Web design

- Social media

- Technology

- Regulations

- Management

- Education

- Finances

- User experience

Newsletter

Sign up for the newsletter and receive the latest trends and tips straight to your inbox