As the season approaches, the first speculations, media attacks, and endless discussions about prices on the coast emerge. Will coffee and an ice cream once again be the hot topics, or is there something more? Despite the traditional “we complain, therefore we exist” mentality, the numbers in the yacht charter industry tell their own story – and it is far from grim. Ivica Žuro delivers a sharp, witty, and data-backed insight into the state of the yacht charter sector, economic trends, and leasing dynamics. Is tourism really on the brink of collapse, or is there something entirely different behind all the panic?

As the season approaches, there will be more and more announcements and speculations about its character.

But it is easy to navigate through this because there is one indicator besides the number of overnight stays and the amount of extra-accommodation spending by guests.

These are media attacks on everything happening on the coast, from private rentals through beach concessionaires to marinas and ports, as well as the inalienable right of our people since arriving at the Adriatic – that is, having coffee on the promenade by the sea and an ice cream scoop for 1 euro.

Given that an increase in tax burden on small renters has been implemented, if even after this measure a media campaign against them follows from the capital's media – it will be no worse than before.

In fact, just the other day, we had the first such "swallow." A man sat on the promenade in Opatija, had a small meal, and was shocked by the price.

Since he could not complain to his wife – neither his own nor someone else's – because they would very likely tell him he had no luck with thinking and question why he had to sit there in the first place, of course, he complained to someone who has understanding for everyone as long as it generates clicks and revenue.

Croatian business as usual, or as the guy in the joke says: I know us, .... us.

Domestic yacht charters are doing great…(?)

Judging by the numbers, domestic yacht charter agencies are doing very well, no matter how much people complain that last year had major problems.

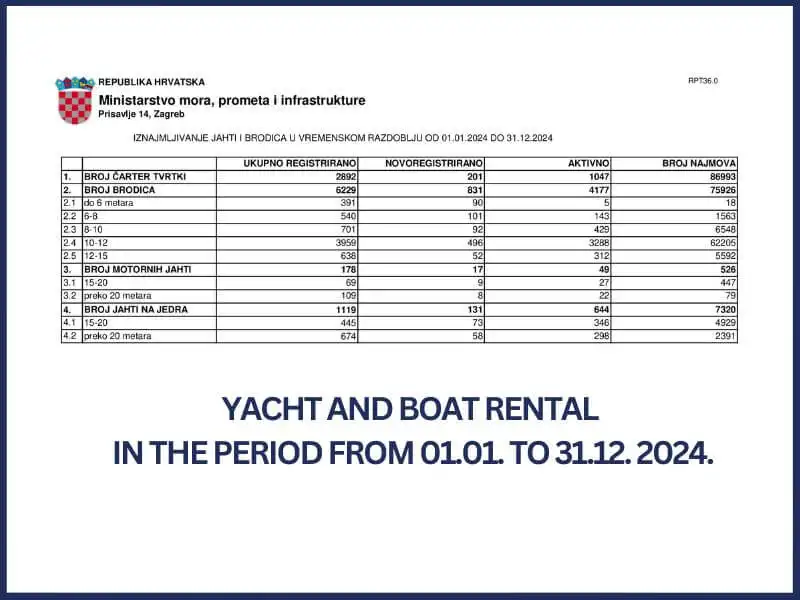

In 2024, there were 201 newly registered companies in the yacht charter sector, as well as 831 new boats with a hull length of up to 15 meters, 131 new sailing yachts with a hull length over 15 meters. Despite the oil crisis, there were also 17 new motor yachts that joined the existing fleet of 178 octane-powered vessels.

Furthermore, the Ministry of the Sea, Transport, and Infrastructure stated that by the end of 2024, there were 1,047 active yacht charter companies that completed 86,993 charters throughout the year.

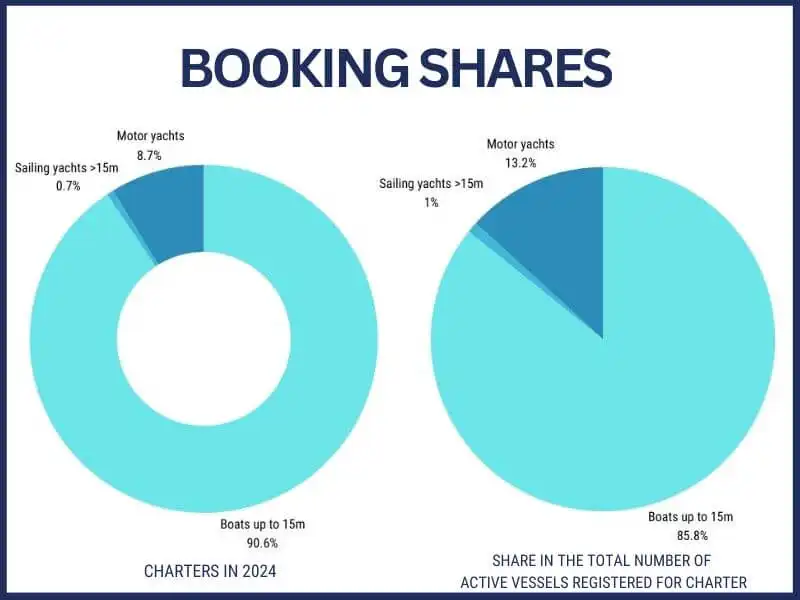

Of these, the lion's share, or 75,926 charters, went to 4,177 active boats, the most sought-after of which were those with a hull length of 10 to 12 meters. A total of 3,288 active units completed 62,205 charters, accounting for 71.5% of all charters.

They were followed by boats with a hull length of 8 to 10 meters, with 429 active units recording 6,548 charters or 7.5% of the total, while relatively sought-after were also those measuring 12-15 meters, with 312 active units completing 5,592 charters or 6.4%.

Sailing yachts were also in high demand in the summer (...in the city):

- those with a hull length of 15-20 meters completed 4,929 charters with 346 active units

- last year, there were 298 active yachts longer than 20 meters, with a total of 2,391 charters.

The image contains figures related to the above.

That the situation cannot be as bad as we tend to complain and whine – as if an average Croatian politician, after two years of parliamentary dining, had stepped on the hand of someone picking a daisy – is proven by the data on vessel procurement.

Namely, as mentioned, a total of 979 new vessels were acquired, of which 788 had a hull length greater than 8m and, as such, were desirable for financing by leasing companies.

Leasing as the main power engine of the yacht charter industry

The records of the domestic financial market supervisory agency HANFA state that in 2024, 473 new vessels were acquired through financial leasing, with a total financed value of 128,112,000 euros or 270,850 euros per vessel.

This means that 60% of the regularly recorded new active vessels in the yacht charter sector were financed through leasing – as is usually done, whether for cost management, cash flow management, or some other reason.

The fact remains that 40% of the new fleet was acquired through other means.

If the existing accumulation of yacht charter companies is great, it's not all that bad, there are companies that know how to make money and invest it further in business development.

Alternatively, businesses from other industries are investing in the yacht charter sector, thereby diversifying their risk… and at the same time, creating problems for existing players by saturating the market. This leads to increased supply in a limited market, which inevitably results in a price war and price dumping to exhaustion.

As for acquiring vessels through leasing, those hoping to get their hands on a vessel from a leasing company due to non-payment, it's not gonna be that easy.

Have leasing companies learned their lesson or…?

Delays in new yacht charter leasing agreements are practically nonexistent, and within the total active portfolio of leasing agreements, only 0.30%, or 846,000 euros, accounts for payments that are a year or more overdue. In practical terms, this concerns only three serious leasing agreements.

The scale of debt for financial leasing in real estate and personal and commercial vehicles is much larger.

Since only financial leasing is mentioned in relation to vessels, and not operational leasing, the explanation is quite simple and can be traced back to the 2008 financial crisis.

Until then, it was relatively common for companies to acquire vessels through operational leasing, where an asset is used but not owned.

Everything was fine, bonuses in the financial sector were flowing freely, not just for Swiss franc loans, until the moment – as a former presidential candidate put it – when 2008 arrived.

Operational leasing and ghosts of the past

At the end of the season, leasing companies were left with vessel keys that they could not easily resell, and up until then, major players with significant market growth potential exited the industry.

The experience of overwintering a fleet that could not be rented out even to cover fixed costs significantly curbed the ambitions of one previously very strong leasing company, whose group, in the meantime, faced other issues that resulted not only in a book but in something more.

In short, since then, operational leasing for vessels has been available on the domestic market only in exceptional cases.

Categories of trends

- News

- Sale

- Marketing

- SEO

- Web design

- Social media

- Technology

- Regulations

- Management

- Education

- Finances

- User experience

Newsletter

Sign up for the newsletter and receive the latest trends and tips straight to your inbox