- 01.10.2024.

- News, Regulations, Finances

The proposed tax reforms in Croatia are sparking intense reactions. While the government claims to strive for fairness, many citizens and experts read "between the lines" and see potential injustices. Will the promised increase in personal deductions truly make a difference, or is it just a drop in the sea of inflation? And what does the drop in interest rates mean for the average citizen? In his latest article, Ivica Žuro reveals what really awaits us behind this financial spectacle's scenes.

In light of the announced tax reform, which has stirred considerable controversy due to increased levies on income from property, other announcements have taken a backseat—such as the increase in the amount of non-taxable income, the elimination of incentives for hiring young workers and raising the threshold for entering the VAT system for flat-rate businesses.

There has been much criticism of the reform, and rightfully so.

Although it hints at fairness, it’s hard to shake the impression that it is quite unfair towards the tourism sector and towards all those who have lived, worked and paid taxes in the Republic of Croatia for years.

Moreover, it discriminates against them based on age and the country in which they live.

Let's break it down step by step.

Property tax – a blow to the tourism sector or salvation for young families?

The property tax was the first loud announcement, and it is expected to particularly impact small renters, as official statements claim that there is a housing shortage and that encouraging long-term rentals through lower taxes should motivate owners to rent to young families.

On paper, it sounds good, but nowhere in the world has this approach of targeting private property proven to achieve the desired effect.

Moreover, unaffordable housing is the main issue in all major cities—but not in places like Komiža, Sutivan, Turanj near Biograd, Omišalj, or Plitvice Lakes.

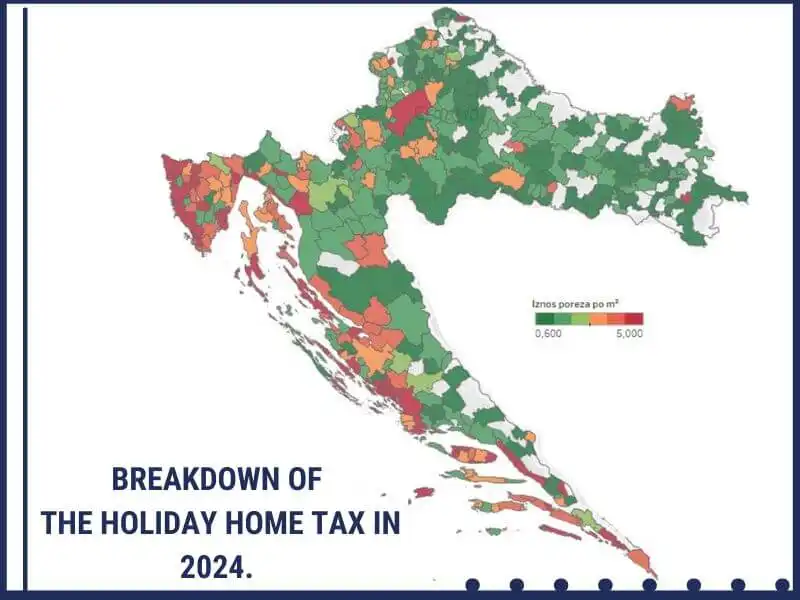

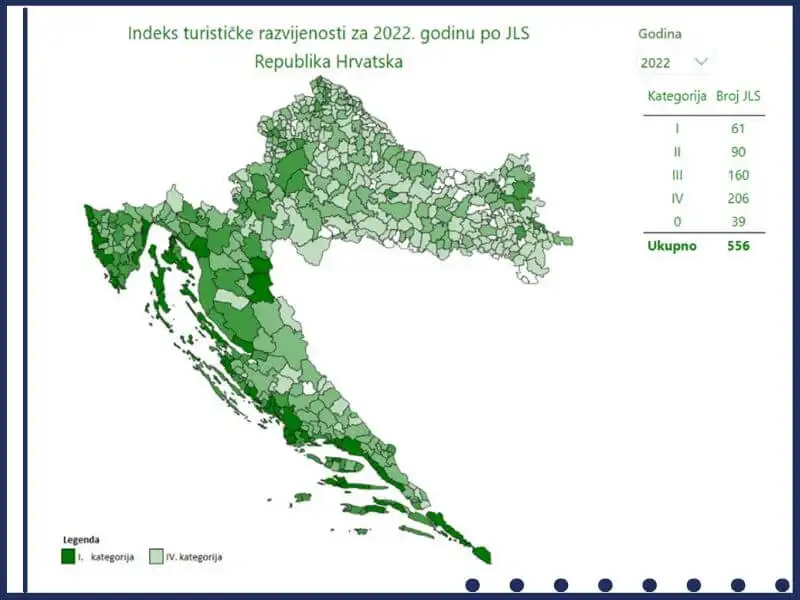

Interestingly, the areas that are intended to face additional taxation are already paying the highest amounts of vacation home taxes and are regions with higher indices of tourism development. Now, they are expected to pay even more for fiscal equalization, effectively providing financial support to the underdeveloped parts of the country.

You’re right, it’s indeed very unfair and inequitable.

Returnees welcome! Loyal citizens? Who cares...

But the unfairness doesn’t stop there.

One of the announced measures is a five-year income tax exemption for Croatian citizens who have lived abroad for the past two years. The same applies to their descendants if they can prove a connection to Croatia.

Additionally, the provision remains that young workers are entirely exempt from paying income tax if they are under 25 years of age and pay only half if they are under 30.

This means that, in the first case, those who have maintained the system by paying income tax are punished, and in the second case, it is those who have proven themselves as long-term, reliable workers—ideal for training younger colleagues—who are at a disadvantage.

In short, who cares—using a less polite verb might be more fitting—that you’ve been diligent, gained experience, and contributed every day, every month, for years as a taxpayer.

Personal deduction - eight euros more (for coffee)

An increase in the individual personal deduction from 560 to 600 euros per month has also been announced.

This would have been great if the personal deduction amount had been consistently adjusted for inflation—as is done by default in Turkey and the USA—but it hasn't been.

And this has led to a massive imbalance.

As of January 1, 2025, with the increase to 600 euros, it turns out that in five years, the increase in the personal deduction on wages was 13%. Meanwhile, the official inflation rate for the same period was 30%.

The numbers are clear: Nominal wages in Croatia may be higher, but due to a significantly higher inflation rate compared to the increase in the deduction, the average citizen actually has considerably less money for spending. Similarly, gross wages have increased by 29% over the past four years, while net wages have grown by only 24%.

The difference has gone to municipalities and cities, where income tax on dependent work accounts for 90% of all revenue.

The announced tax reform will not spur any significant change, as most employees will still remain below the taxable income threshold due to low wages.

The extra eight euros per month that most employees will receive amounts to one coffee with milk for four people in a neighbourhood café in the morning.

It remains to be seen what will ultimately be passed in the domestic Parliament.

Falling interest rates – finally the end of suffering?

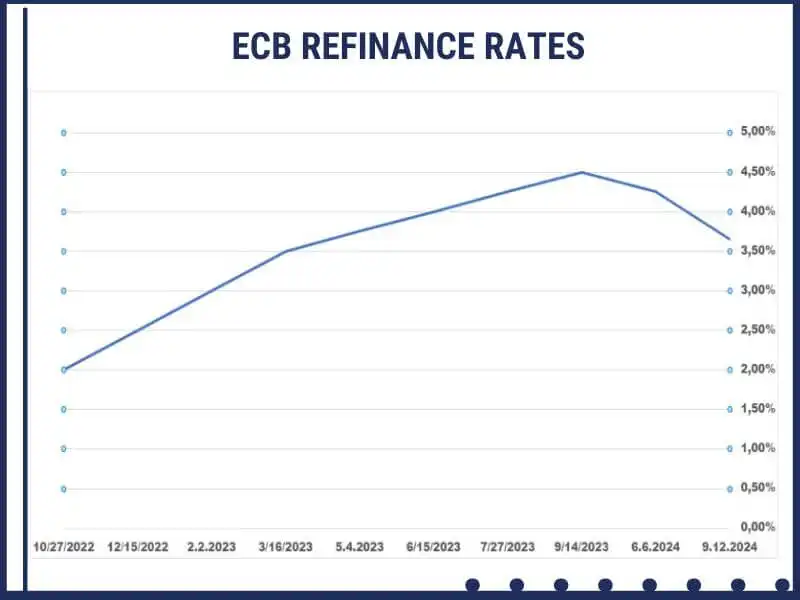

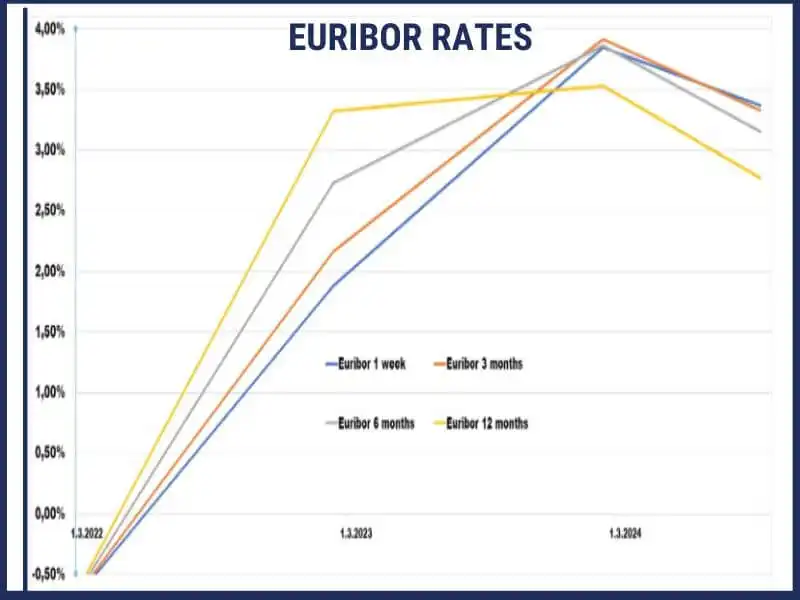

Interest rates in the markets have started to actively fall.

After the Eurozone's reduction in interest rates, the US Federal Reserve followed suit, signalling the need to stimulate economic growth.

Unlike the previous hesitation with raising official interest rates in the financial market—a move that frustrated analysts but made sense due to rising energy and material costs—this time, the European Central Bank is among the leaders of this trend.

Taxpayers, voters, and consumers are increasingly drained by higher prices across the board, and public opinion surveys indicate growing dissatisfaction with energy policies. Moreover, EU businesses are lagging further behind those in the USA and China.

It doesn’t help that the EU has no intention of reducing its bureaucratic apparatus and continues using money as a way to appease those expressing dissatisfaction. It’s the same everywhere.

All these political factors, along with the economic downturn, point to just one solution: more money and more favourable credit conditions to stimulate consumption.

Because without consumption, a market-based society cannot move forward.

HBOR's move: no more subsidies – but better loans for entrepreneurs

The domestic development bank, the Croatian Bank for Reconstruction and Development (HBOR), has also joined the trend of lowering interest rates, and as of the end of September, it has stopped accepting applications for interest rate subsidies under the National Recovery and Resilience Plan (NPOO) for the private sector.

On the other hand, to ensure the continuation of favourable financing, HBOR has reduced interest rates across several of its regular programs.

Thus, the interest rate in the "Entrepreneurship for Youth, Women, Startups, and Other Special Segments" program will now be very competitive, with 2.00% fixed annually, which is half of what it used to be.

In addition, the maximum loan amount has been increased to 400,000 euros, which is significantly more than the previous limit of 300,000 euros.

The program has also been expanded to cover all micro, small, and medium enterprises investing in specific areas of Croatia, as well as entrepreneurs investing in the commercialization of projects based on research, development, and innovation.

For medium and large private investors, guarantees under NPOO funds remain available for investments financed by commercial banks, leasing companies, or HBOR.

Depending on the type of investment and state aid regulations, the coverage can include guarantees for up to 80% of the principal, subsidies for guarantee fees up to 100% of the amount, and interest subsidies for up to 75% of the loan amount.

These guarantees are intended for investments in green and digital transitions, investments in specific areas of Croatia, projects based on research, development and innovation, or investments specifically targeting research, development, and innovation, as well as any other investments aimed at increasing competitiveness and resilience.

Categories of trends

- News

- Sale

- Marketing

- SEO

- Web design

- Social media

- Technology

- Regulations

- Management

- Education

- Finances

- User experience

Newsletter

Sign up for the newsletter and receive the latest trends and tips straight to your inbox