Do you have an idea, but you’re missing a million or two (or maybe twenty)? Clearly, it’s time for new investments. Ivica Žuro brings us the most important information about current financial programs and loans for entrepreneurs in tourism and hospitality. From debt forgiveness to green initiatives – learn how to lay the foundation for success in the coming year.

Godina je prošla, a na srcu mom je ista želja (The year has passed, but the same desire remains in my heart)... These are the lyrics from a great hit from the late 80s, whose emotion was so strong that people drank water from radiators and not anything else stronger and more substantial.

The accounting and business period has come to an end, accounts are being settled and statistics are being calculated, and preparations for the next year are already underway. In this spirit, the last column of the year will focus on financing and tracking investments.

From million to million – investment loans

Traditional loans, whether for working capital or investment loans, on the domestic market typically go up to a maximum of 4 million euros with most banks, and usually have a repayment period of up to 10, or in rarer cases, 12 years.

Some banks are able to offer up to 7 million euros. Anything beyond that usually involves club financing or syndicated loans provided by a group of banks.

If you still need financing for an investment exceeding 20 million euros, there is a solution for that as well.

There are funds on the market willing to invest in various larger projects with a clear return perspective, and they are prepared to finance part of the equity if that is currently an issue.

Who is more interested in it - knows where to find it.

Green tourism – an investment that forgives (principal)

The main focus of this month’s story is the program of the domestic development bank HBOR – the Sustainable Tourism Loan, which secures a total of 170 million euros from the European Regional Development Fund (ERDF) and HBOR itself. The program has been open since mid-November, and applications are submitted directly to this institution.

The program focuses on financing projects that contribute to the green transition, improve the quality of tourism services, and develop innovative and sustainable tourism products through upgrading accommodation categories or building new capacities, with a minimum of 3 stars.

Eligible investments include the construction, reconstruction, and equipping of hospitality facilities, as well as additional amenities that increase accommodation capacities.

What’s specific is that this is a loan instrument with principal forgiveness if the amount exceeds half a million euros.

The minimum loan amount is 250,000 EUR and the maximum is 7,000,000 EUR, with HBOR financing up to 85% of the investment value, while the remaining 15% must be secured by the investing company.

Debt forgiveness, incentives, and rules of the game

If the borrower qualifies for debt forgiveness as regional support, then the amount of their own contribution increases to at least 25% of eligible costs from their own or other sources, which cannot be in the form of any state aid.

For working capital, it can go up to 30% of the loan amount, which means, for example, in the case of an investment of 1,000,000.00 euros.

If everything is satisfied and the project is deemed acceptable from multiple aspects, the contract is signed. The loan disbursement is made based on the request for the use of the loan, along with the supplier or contractor invoices.

What are the interest rates?

The favorable interest rate on the portion of the loan principal from the ERDF funds is 0.00% per year, fixed, while the interest rate on the portion of the loan principal from HBOR funds is calculated with a fixed rate, which is determined separately for each loan based on a risk assessment.

For investments up to 400,000 EUR, a business plan is required, while for investments above 400,000 EUR, an investment study is needed.

Special benefits – debt forgiveness and tax reductions

Let’s return to the principal forgiveness, where the entrepreneur is in a position to receive 30% to 50% debt forgiveness if all planned criteria are met, meaning if the categorization is achieved and the investment takes place in an area with a lower tourism development index.

The types of properties that are eligible for investment are as follows:

- Hotel

- Heritage hotel

- Diffused hotel

- Aparthotel

- Tourist resort

- Spa types: Spa heritage hotel, Spa hotel, Spa aparthotel, Spa tourist resort, Spa diffused hotel

- Hotels of special standards: Business hotel, Meetings hotel, Congress hotel, Club hotel, Holiday resort hotel, Coastal holiday resort hotel, Family hotel, Small & friendly hotel, Senior citizens hotel, Health & fitness hotel, Wellness hotel, Diving club hotel, Motel hotel, Ski hotel, Hotel for people with disabilities, Bike hotel

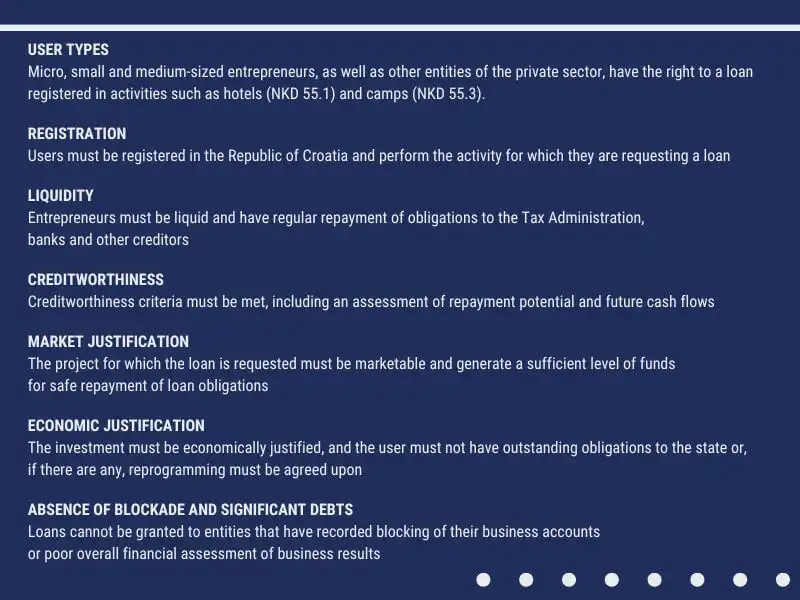

In the end, some basic (pre)conditions still need to be met, as seen:

But that’s not all – as they say in advertisements for various seasonal offers.

Those who play, win – opportunities for tax reduction

Entrepreneurs in hospitality and tourism are also entitled to a reduced corporate income tax rate.

This is part of regional support measures aimed at encouraging investment in tourism, particularly in less developed regions.

Anyone who operates for at least six months a year, whether in accommodation, cultural heritage restoration, health tourism, or infrastructure development, can benefit from a reduction in the corporate income tax rate by 50%, 75%, or even 100%, depending on the investment amount and the number of new jobs created.

The following businesses are eligible for tax reductions:

a) Code 55 NKD: Accommodation

b) Code 56 NKD: Food and beverage service activities

c) Code 79 NKD: Travel agencies, tour operators, and other reservation services and related activities

d) Code 93 NKD: Sports activities, and entertainment and recreation activities

e) Code 77.34 NKD: Leasing and renting of water transport equipment

Eligible investments include the following types of properties:

- Accommodation facilities (hotels, aparthotels, campsites) with at least 4 stars.

- Heritage hotels and diffused hotels that restore cultural and historical heritage.

- Supporting services such as health, congress, nautical, sports, cultural, and ecological tourism.

- Health tourism and infrastructure for high-added-value tourism.

- Nautical tourism with at least 4 anchorages.

- Amusement and theme parks.

- Restaurants and bars with a minimum investment of 1,000,000 euros.

- Investments in clean vessels that use electric energy or hydrogen.

Anything not listed in the above categories is not eligible, and if eligibility cannot be achieved, despite what others may say, it is best to turn to something else.

The smallest cost is money; much bigger costs are energy and effort, but the biggest cost is time.

Lastly, there is a benefit for entrepreneurs who use state-owned property.

Those who start projects in tourism, sports infrastructure, and amusement or theme parks can also qualify for a reduction in the fee for using state-owned property.

To meet the conditions, they must invest at least 3 million euros in tangible assets, create at least 15 new jobs within three years, and ensure compliance with the applicable spatial plans and regulations.

Categories of trends

- News

- Sale

- Marketing

- SEO

- Web design

- Social media

- Technology

- Regulations

- Management

- Education

- Finances

- User experience

Newsletter

Sign up for the newsletter and receive the latest trends and tips straight to your inbox